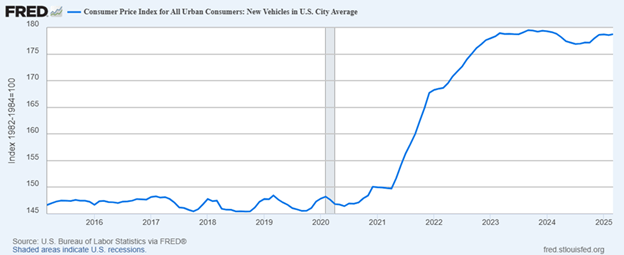

Will climbing prices keep new cars unaffordable and is Washington telling the U.S. consumers to drop dead?

In recent years new car prices have skyrocketed. What started out as a lack of semiconductors for vehicles during the pandemic is turning into a new normal. The industry is well past the semiconductor and supply chain issues, yet sky high prices remain.

In the last year automakers made more than $20 billion in profit. As the U.S. industry has no incentive to lower prices, they will likely use new tariffs as the reason for continued high prices.

At the same time China has made remarkable progress in manufacturing and exporting Electric Vehicles. Fear of competition has driven the last two Presidents to put tariffs of 100% on these EVs from China. Surely this can’t all be Elon’s fault?

Haunted by Plaza?

While President Ronald Reagan is considered a free trade advocate he was anything but when it came to importing cars form Japan. Reagan negotiated strict quotas that limited the US imports of Japanese vehicles. These were labeled “Voluntary Exports Restraints.”

When this was not restrictive enough, the U.S. sought to increase the prices of Japanese imports through the Plaza Accords of 1985. This included increasing the value of the Japanese yen.

Eventually, the U.S. and China will likely reach a modern “Voluntary Export Restraint” type of quota or tariff rate quota system.

However, a repeat of the Plaza Accord is unlikely.

The U.S. has been trying to get the Chinese to lower the value of their currency and increase domestic Chinese demand for years. Neither has occurred. Harvard Economist and author of, “Our Dollar, Your Problem,” Ken Rogoff, explained that while the Japanese sought to increase the value of the yen by ten percent to comply with the Plaza Accord, it eventually became far more expensive. This increasing value led to greater investment in the country. This investment further inflated Japan’s growing real estate bubble, until it burst.

The perception in Asia is that the Plaza Accords led to economic collapse and stagnation in Japan. Japan’s stock market would not reach its 1989 high again until 2024.

Rogoff compares the Japanese economic fallout in 1989 to the US Great Recession when borrowing became too cheap to be sustainable.

In recent years China has experienced a similar real estate boom and bust. According to Rogoff, the Chinese are saying ‘you’re not going to do this to us. You are not going to bully us.’

Subscribe

Subscribe to get our the latest stories in your inbox.

Subscribe

Subscribe to get our the latest stories in your inbox.

.entry-title {

text-align: center;

}